“It is believed that the intelligent upgrade of the bathroom space has become an irreversible trend.” October 26, by the Chinese Household Electrical Appliances Association guidance, China Power Grid hosted the “wisdom – healing – enjoy the space 2023 China’s intelligent sanitary ware industry summit forum” was held in Foshan, China Household Electrical Appliances Association, vice president of Zhu Jun, said that, as a smart sanitary ware system in the core of the single product, intelligent toilet in the first two years of the epidemic in the context of a special , the industry continues to achieve more than ten million units of production for two consecutive years, which shows that the market is healthy and robust, the product has been recognized by a certain number of consumers, “I believe that the intelligent upgrading of the sanitary space has become an irreversible trend.”

Sanitary ware industry consists of sanitary ceramics, faucet hardware, bathroom cabinets, bathtubs and other products. Sanitary ceramics include bidet, squatting toilet, urinal, basin, etc.; faucet hardware includes showerhead, faucet, floor drain, and pendant.

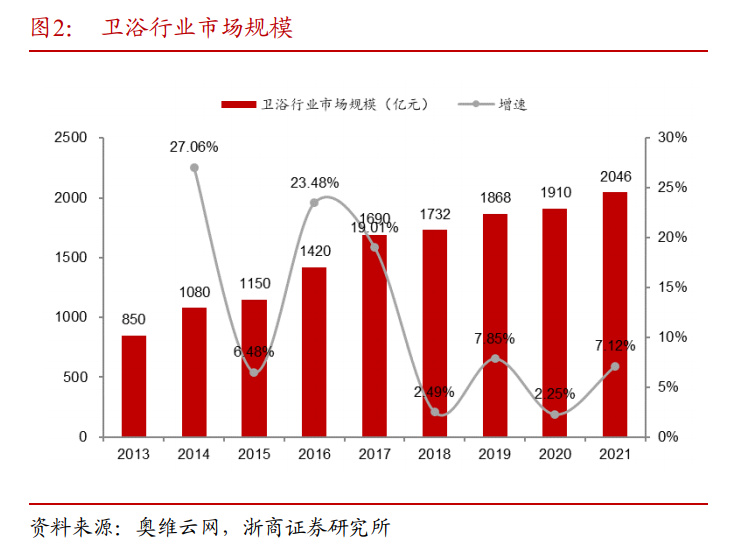

Sanitary ware industry 200 billion market, toilet for 40 billion core single product. 2021 China sanitary ware market size of 204.6 billion yuan, 2017-2021 compound annual growth rate of 5%, the industry has entered a stable growth stage. By category, faucet hardware / sanitary ceramics / bath room bath cabinet / bathtub bathtub market accounted for 45% / 26% / 16% / 12%. Among them, the commode (bidet and squatting toilet) is a high-value volume of the core single product, the market size of about 40 billion yuan, split the volume of price, the price of the commode with reference to the Wrigley, retail factory average price of about 800 yuan, the average price of the project factory average price of about 300 yuan; our volume of measurement based on the assumptions: 1) residential single-family supporting the number of 1.5 toilets; 2) second-hand toilet re-installation rate of 80%; 3) stock of residential every 15 years to be reinstalled once a toilet, the number of toilet, the number of people who need to be reinstalled once a year, the number of people who need to be reinstalled once a year. Toilet seat reinstallation rate of 80% in second-hand houses; 3) the stock of residential housing needs to be reinstalled once every 15 years, and 80% of the users choose to refurbish the toilet seat, so that the residential demand for toilet seat in 2022 will be nearly 45 million sets, and we expect that the non-residential demand (including schools, hospitals, office buildings, shopping malls, etc.) will be about 10 million sets, which will result in a total demand for toilet seat of about 55 million sets. On the structure of demand, in 2022, the proportion of new houses/second-hand houses/inventory of residential renovation/non-residential demand will be 30%/7%/45%/18%.

Bathroom intelligent penetration accelerated, driving the industry to speed up again. Intelligent sanitary products mainly include intelligent toilet, thermostatic shower (bath screen), intelligent bath mirror, intelligent bath heater, intelligent bathtub and other products. In recent years, the demand for smart sanitary ware B-side and C-side has been booming: 1) the supporting rate of B-side decoration houses continues to rise, according to Aowei, in 2022, the supporting rate of smart toilet decoration is 28.5%/yoy+3pct, the supporting rate of shower screen decoration is 76.1%/yoy+6.4pct, and the supporting rate of bathtub decoration is 71.9%/yoy+1.7pct; 2) the consumption of C-side is growing fast, according to Jiuqian, in 2022, Tmall will launch a series of smart bathroom products, including smart toilet, thermostatic shower (bath screen), smart bath mirror, smart bathtub and other products. Jiuqian, the two smart bathroom categories with the highest sales on Tmall in 2022 are smart toilet/smart shower, and the GMV compound growth rate of smart toilet in 2017-2022 is 23% respectively. The accelerated penetration of intelligence can promote the demand for bathroom replacement, while the unit price of intelligent bathroom products is higher than ordinary products, driving the bathroom industry into a new phase of Bathroom category and other home furnishing category characteristics are similar: 1) upstream raw material costs accounted for a high proportion (mainly clay raw materials, glaze raw materials, gypsum powder, copper, glass and wood, etc.), bathroom products gross margin will be affected by raw material price fluctuations, but because the downstream is mainly docked to the seller, can be transmitted through the end-product price increases; 2) the downstream demand is mainly demand for residential renovation, belonging to the real estate industry, the real estate cycle, affected by the big influence of the real estate cycle. Real estate cycle is greatly affected.

Bathroom category is different from other home furnishing categories: 1) The downstream demand structure is more complex: in addition to the demand for new houses and second-hand houses, the demand for residential renewal and non-residential demand (including schools, hospitals, office buildings, shopping malls, etc.) accounts for a higher proportion of which the demand for residential renewal accounts for a higher proportion of which stems from the shorter renewal cycle of the toilet bowl. This is a higher requirement for sanitary ware brand’s multi-channel layout and traffic integration ability.2) Stronger brand effect: sanitary ware is one of the few categories of household products with brand logo exposure, and there is a brand effect. According to the “2020 China Sanitary Ware Purchase Decision Research Report” by Ceres Competitive Intelligence Research Institute, consumers take cost-effectiveness, brand, function, after-sales service and design as the top five decision-making factors when purchasing sanitary ware products. The rise of intelligent sanitary ware in recent years has strengthened consumers’ reliance on sanitary ware brands, and consumers are willing to pay a certain brand premium to ensure the stability of functionality, while the strong functionality of timely maintenance and after-sales service requirements have also increased, in addition, sanitary ceramics products also have a certain design aesthetics requirements, which require continued investment in support of the brand.

(3) accelerate the replacement cycle: the rise of intelligent sanitary ware has accelerated the replacement cycle of the sanitary ware category, mainly from three aspects: 1) intelligent product substitution; 2) intelligent sanitary ware replacement cycle is shorter (related to the maintenance cycle of the functional products); 3) from the supply side, intelligent sanitary ware needs to continue to function continuous iterative upgrading, the product innovation cycle is shorter, according to the Aowei Yun.com, the mainstream brands of intelligent toilet integrated machine product structure within 1 year, new products accounted for 1/3.4 New products accounted for 1/3.5 The new products accounted for 1/3 of the new products. 4) Stronger set of sales: when consumers buy sanitary products, there is a distinctive toilet as a big single product, along with washbasin, hardware, bathroom cabinets and other sets of extended purchase habit characteristics.B-end decoration market also has set of procurement characteristics, according to Aowei Yun.com, the washbasin, toilet, shower market pattern has similarity.

Post time: Dec-16-2023